Oil exploration in Uruguay

The company’s biggest foreign commitments may have been in the USA and Canada, but exploration activity in Latin America after 2020 was also fairly massive. It covered a number of countries, and the entry into Uruguay helped to reinforce this drive. The core area was Uruguay’s neighbour to the north, Brazil, where Statoil had been present since 2001 and had secured operator responsibility for a producing field in the shape of Peregrino. The company had been present even longer in Venezuela, where it produced viscous heavy crude. Otherwise, exploration was being pursued offshore in Suriname from 2013, Colombia from 2014, Nicaragua from 2015, Mexico from 2016 and eventually Argentina from 2017.

Smallest and most successful

Uruguay is one of the smallest countries in South America, with a population of 3.4 million and a location between Argentina and Brazil. It is regarded as one of the most successful Latin American nations in many areas.[REMOVE]Fotnote: https://www.doingbusiness.org/content/dam/doingBusiness/country/u/uruguay/URY.pdf. That included relatively well-functioning democratic institutions, which was partly because it had not been exploited to the same extent as other former colonies in Latin America.

This is no “oil country”. Its economy is characterised by farming and exports of agricultural produce. Cattle and sheep dominate, with meat, wool and hides sold abroad. Soya beans have also become an important export commodity in recent years.[REMOVE]Fotnote: https://www.fn.no/Land/uruguay.

Statoil farms in

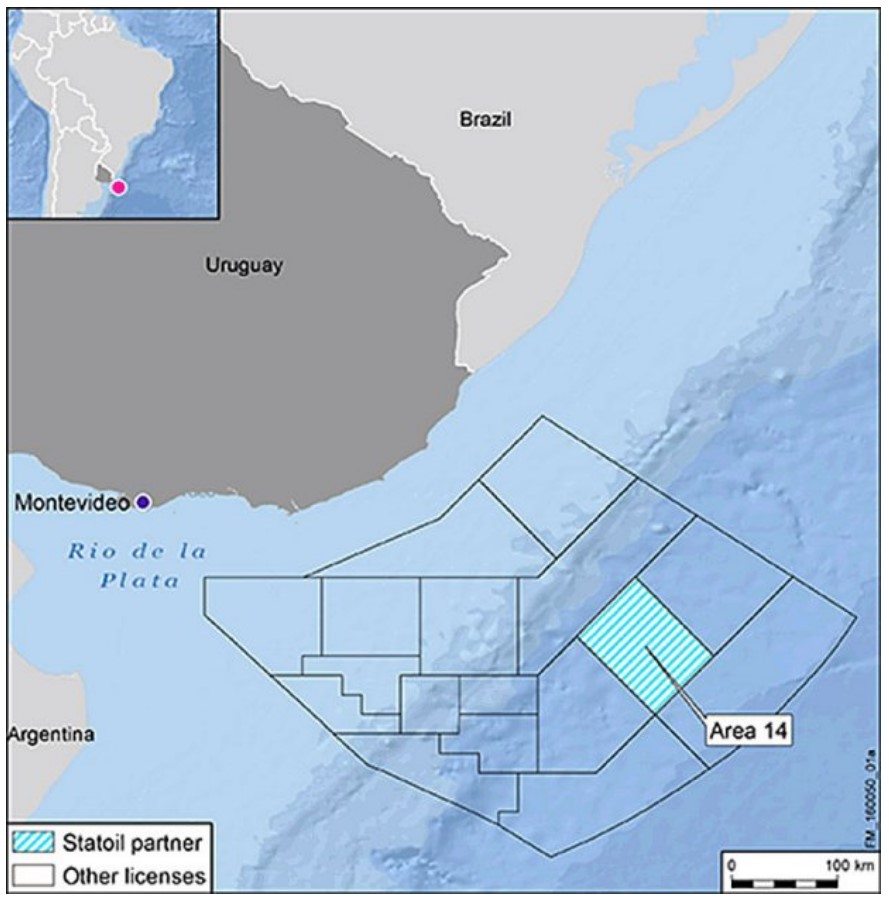

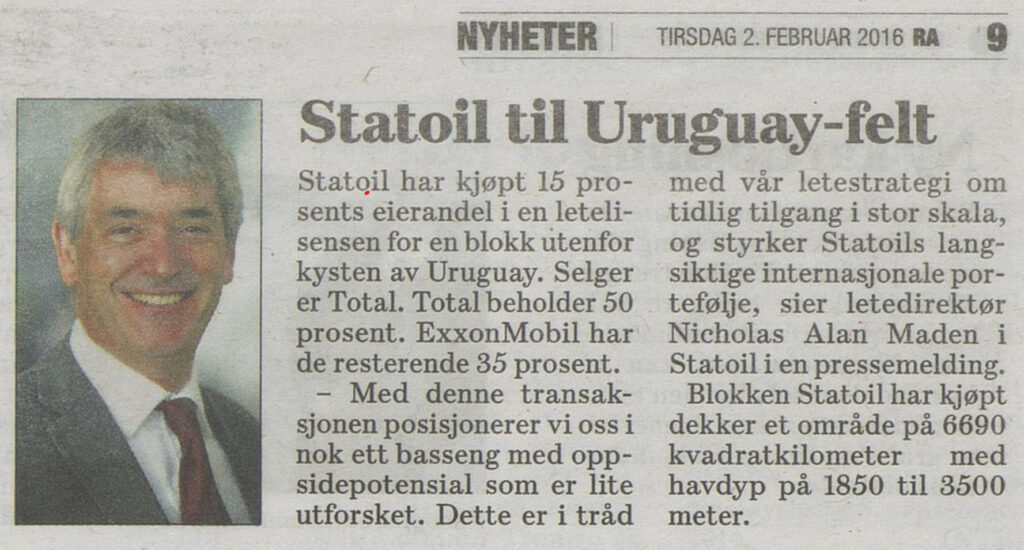

The company’s first Uruguayan farm-in occurred on 1 February 2016, when it acquired a 15 per cent interest from Total in an exploration licence in block 14 of the Pelotas Basin. Awarded in 2012, this acreage lies about 200 kilometres off Uruguay.[REMOVE]Fotnote: Stavanger Aftenblad, 1 February 2016, “Statoil kjøper seg inn i letelisens i Uruguay”. Total was the operator, with 50 per cent after the farm-out, and ExxonMobil had 35 per cent.

When Statoil’s acquisition was announced, Nicholas Alan Maden, senior vice president for exploration, had the same comment as when the company entered several other countries: “With this transaction, we are positioning ourselves in yet another underexplored basin with upside potential. This is in line with our exploration strategy of early access at scale, and strengthens Statoil’s long-term international portfolio”.[REMOVE]Fotnote: Nettavisen, 1 February 2016, “Statoil kjøper lisensandel i Uruguay”. His words expressed moderate expectations.

The block covered 6 690 square kilometres with water depths of 1 850 to 3 500 metres. Before Statoil’s entry, Total had already completed an extensive data acquisition programme – including new three-dimensional seismic surveying of the whole acreage. Exploration drilling began in the first half of 206. As the results were accumulated, the partners would decide what to do next.[REMOVE]Fotnote: Equinor press release, 1 February 2016, “Statoil to explore offshore Uruguay”.

In parallel, Statoil signed an agreement on 15 February 2016 with Irish oil company Tullow, which had its head office in London. This covered acquisition of a 35 per cent holding in block 15, neighbouring the Total licence. Tullow retained the operatorship with 35 per cent, while Japan’s Inpex held the remaining 30 per cent. Block 15 covered more than 8 000 square kilometres and lay in waters 2 000-3 000 metres deep.

Tullow had also completed extensive data acquisition on the acreage, and plans called for 3D seismic information to be acquired before a decision was taken on moving exploration drilling.[REMOVE]Fotnote: E-24, 15 February 2016, “Statoil kjøper seg opp i Uruguay”.

Out of Uruguay

Statoil/Equinor’s involvement in exploring these two blocks failed to bear fruit in the form of discoveries, operatorships or developments. As a result of the change to its exploration strategy, which involved concentrating on a few core areas, the company withdrew from Uruguay after meeting the obligations it had taken on.

A similar development occurred in several of the countries which had been entered after 2010. The withdrawal across a number of fronts partly reflected low oil prices after 2014 and their effect on company strategy.

In 2020, Equinor reported the write-off of USD 74 million spent on exploration activities in Uruguay.[REMOVE]Fotnote: Annual report, 2020, Equinor: 304. No gain had been made. Uruguay was therefore part of the story on reducing the company’s geographic range from about 30 countries in 2014 to 15.

arrow_backNew life for Frigg gas field?From fracking to renewables in Argentinaarrow_forward