Mexico – brief affair in denationalised waters

Establishing a representative office in Mexico City was part of the company’s long-term focus on gaining entry to new exploration areas and securing operator assignments internationally.[REMOVE]Fotnote: Statoil annual report, 2001: 12. With hindsight, however, this move might appear a little premature on Statoil’s part.[REMOVE]Fotnote: Knut Henrik Jakobsson, the local representative for many years, was familiar with the collaboration agreement and opportunities to carry out assignments on behalf of Pemex. Legislation set limits on who could secure rights/licences in Mexico. Aahein, Sjur M, Equinor 50 års FB side, 16 August 2021.

This was because the Mexican oil industry was still fully nationalised, as had been the case since 1938. That was when then president Lázaro Cárdenas del Río expropriated all foreign-owned oil resources in Mexico, and the state-owned oil company Petróleos Mexicanos (Pemex) was established. It was not until 2014 that it became clear this oil monopoly would be abolished, and Statoil kept a close eye on developments.[REMOVE]Fotnote: NTB, “Statoil følger Mexicos olje-åpning”, Dagens Næringsliv, 12 August 2014. https://www.dn.no/mexico/statoil-folger-mexicos-olje-apning/1-1-5168430. Accessed 15 July 2021.

In and out of the Salina basin

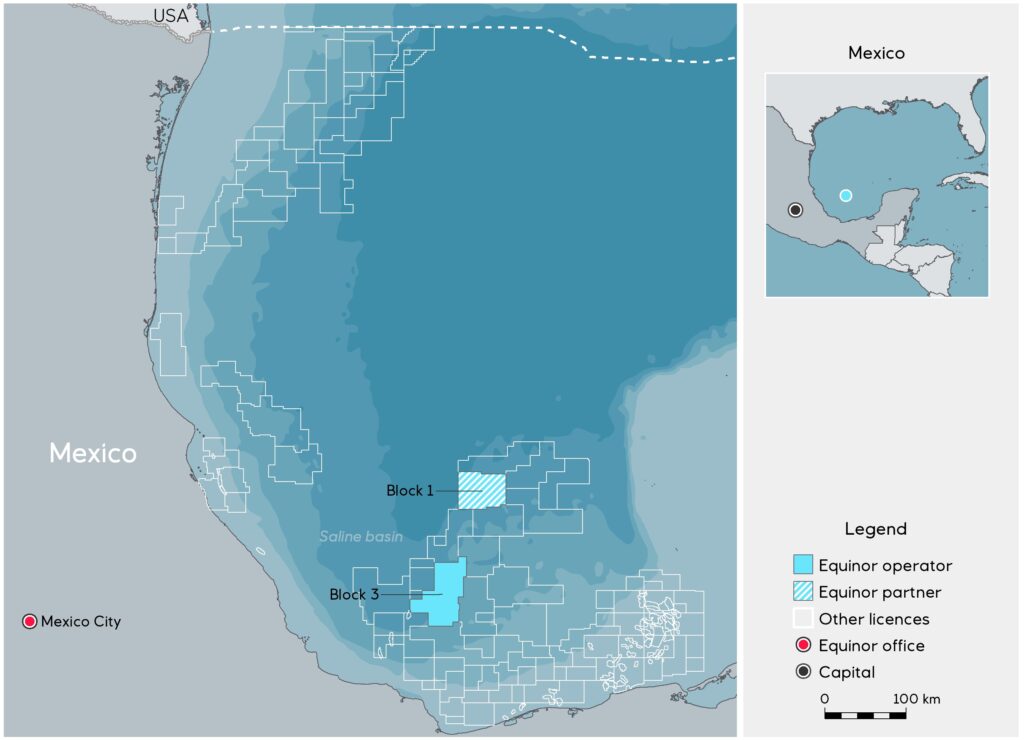

Statoil participated in what became Mexico’s first public bidding round in 2016, where it qualified to participate in two of 15 bids as part of a consortium with Total and BP.[REMOVE]Fotnote: “Statoil prekvalifisert for auksjon i Mexico”, Energi24, 29 November 2016. https://energi24.no/nyheter/internasjonalt/statoil-prekvalifisert-for-auksjon-i-mexico. This secured blocks 1 and 3 in the GoM’s Salina basin, which covered a combined area of 5 650 square kilometres and had maximum water depths of 3 100 and 2 500 metres respectively.

The Mexican authorities reported that block 1 contained light and extra light crude oil totalling some 1 852 billion barrels of oil equivalent (boe).[REMOVE]Fotnote: Ekeseth, Fredrik Chr, “Statoil-konsortium tildelt historisk lisens i Mexico”, Dagens Næringsliv, 5 December 2016. https://www.dn.no/energi/mexico/bp/statoil-konsortium-tildelt-historisk-lisens-i-mexico/2-1-15699. Accessed 15 July 2021; Chetwynd, Gareth, “Country exits: Equinor to drop Mexican deep-water assets as focus shifts”, Upstream, 18 June 2021. https://www.upstreamonline.com/production/country-exits-equinor-to-drop-mexican-deep-water-assets-as-focus-shifts/2-1-1027565. Accessed 15 July 2021. Each consortium member held a third of the blocks, with Equinor operator for block 3 and BP for block 1.[REMOVE]Fotnote: Mexico, Equinor, https://www.equinor.com/where-we-are/mexico. Accessed 15 July 2021.

According to Tore Løseth, then Statoil’s exploration head for the USA and Mexico, the block award involved both considerable uncertainty and a substantial potential. [REMOVE]Fotnote: Ekeseth, Fredrik Chr, “Statoil-konsortium tildelt historisk lisens i Mexico”, Dagens Næringsliv, 5 December 2016, https://www.dn.no/energi/mexico/bp/statoil-konsortium-tildelt-historisk-lisens-i-mexico/2-1-15699. Accessed 15 July 2021. Given that the commitment in Mexico fell under Statoil’s US department and that the Salina basin blocks were deepwater acreage, it is natural to see this involvement as an extension of the much greater activity in the deep parts of the US GoM.

The completely new opportunities opened up in Mexico for the oil industry by denationalisation undoubtedly encouraged Equinor’s international division to envisage that it could have a bright future in the Latin American country. In the run-up to the above-mentioned bidding round in 2016, Tore Haldorsen, Statoil’s vice president for Mexico, went so far as to urge unemployed people in Norway’s oil sector to learn Spanish and move there. This reflected his belief that the region offered good prospects.[REMOVE]Fotnote: Mehren, Nils and Rostad, Ida Lousie, “Statoil har trua på ny olje: – Lær deg spansk og flytt til Mexico”, NRK, 14 March 2016, https://www.nrk.no/tromsogfinnmark/statoil-har-trua-pa-ny-olje_-_-laer-deg-spansk-og-flytt-til-mexico-1.12852436. Accessed 15 July 2021.

Despite the optimism, Equinor got no further in Mexico. In June 2021, executive vice president Al Cook announced that its involvement there would be wound up. This reflected a general scaling back of the company’s international involvement in order to make the portfolio more robust.[REMOVE]Fotnote: Lorentzen, Marius, “Equinor forlater Nicaragua og Mexico: Vil også selge i USA, Canada og Argentina”, E24, 15 June 2021. https://e24.no/olje-og-energi/i/Kyda1G/equinor-forlater-nicaragua-og-mexico-vil-ogsaa-selge-i-usa-canada-og-argentina. Accessed 9 July 2021. All that remained at this point was work programme which included geological surveys of the Salina basin blocks.[REMOVE]Fotnote: Chetwynd, Gareth, “Country exits: Equinor to drop Mexican deep-water assets as focus shifts”, Upstream, 18 June 2021. https://www.upstreamonline.com/production/country-exits-equinor-to-drop-mexican-deep-water-assets-as-focus-shifts/2-1-1027565. Accessed 15 July 2021.