When an iceberg grew into a mong

“It was as if an iceberg came drifting, its contours and size difficult to judge,” commented Statoil’s then CEO Arve Johnsen.[REMOVE]Fotnote: Johnsen, Arve, 1990, Gjennombrudd og vekst: Statoil-år 1978 til 1987. Gyldendal: 288. He thereby painted an almost mystical picture of the Mongstad defeat, of a budget which swelled from a dot on the horizon into a huge mountain with most of its bulk hidden beneath the waves.

NOK 4.2 billion

The Storting (parliament) approved a modernisation of the refinery in 1984 which would expand annual capacity to 6.5 million tonnes and add a crude oil terminal. Its overall cost was estimated at NOK 4.2 billion.

This project was initially a collaboration between Statoil and Norsk Hydro, which jointly owned the facility. However, Hydro pulled out of the expansion in October 1985 while retaining its 30 per cent shareholding in the old refinery.

The modernised plant was originally due to be ready on 1 March 1989. As early as 1985, however, before design work was completed, Statoil decided to bring that date back to 1 December 1988. Speeding up the project would increase its cost but ensure that the facility began earning money three months earlier than planned.[REMOVE]Fotnote: Nerheim, Gunnar, 1996, En gassnasjon blir til, vol 2, Norsk oljehistorie, Leseselskapet: 245. But this was only one explanation for why the budget swelled by several billion kroner.

Six of the worst

In fact, the Statoil management presented the board with six reasons why the Mongstad project became so much more expensive than first planned.

- The amount of work involved was greater than expected.

- Drawings of the site and the existing refinery were inadequate. This meant that piping and cable ducts had to be redrafted, and more of them had to be replaced than first estimated.

- Prices for electrical and instrumentation work were about 50 per cent higher than for the Kårstø gas terminal, which came on line in 1985.

- Everything from design to execution took longer and was more extensive than expected, and therefore correspondingly more expensive.

- To meet the schedule, work on various parts of the facility had to be done in parallel – which added to costs.

- Norway’s construction industry was enjoying boom times, and could therefore charge high prices.[REMOVE]Fotnote: Ibid: 248.

Johnsen has highlighted the second point in particular – that drawings of the existing refinery were deficient and quite simply did not match what was on the ground – as an important factor in making the project significantly more expensive.[REMOVE]Fotnote: Interview with Arve Johnsen, https://tv.nrk.no/serie/mitt-liv/sesong/2/episode/3, accessed 12 April 2021.

Cost overruns are common in the oil industry, although not perhaps as large as in the Mongstad case.[REMOVE]Fotnote: Thomassen, Eivind, 2020, The Crude Means to Mastery. Norwegian National Oil Company Statoil (Equinor) and the Norwegian State 1972-2001: 197. Oil prices are hard to foresee, and it is difficult to predict how the petroleum market will develop. However, the criticism levelled at Statoil related not to the overrun itself but to the way it had been handled.

The company was not blamed for underbudgeting the project. However, the White Paper published in the wake of the budget overrun censured it for failing to pick up the danger signs earlier. “The degree of difficulty in the project was underestimated as early as the initial studies by everyone involved in the many reports and studies produced. That applies to those produced both with Statoil’s own expertise and by consultants. Statoil’s board was also guilty of an over-assessment of this kind.”[REMOVE]Fotnote: Report no 16 (1987-88) to the Storting, Kostnadsoverskridelsene ved utbyggingen av raffineriet og råoljeterminalen på Mongstad: 76 https://stortinget.no/no/Saker-og-publikasjoner/Stortingsforhandlinger/Lesevisning/?p=1987-88&paid=3&wid=b&psid=DIVL495; Redegjørelse for utviklingen i investeringsestimatene for Mongstadprosjektene, appendix to report no 16; both quoted in Nerheim, Gunnar, op.cit: 251 and 249.

A typical question asked was whether the project should, or could, have been halted earlier.

Point of no return

As noted above, total investment in the Mongstad project had been put at NOK 4.2 billion in 1983 value.

The report written after the cost overruns notes that the Statoil management knew as early as 1985 that this budget would not hold.[REMOVE]Fotnote: Report no 16, op.cit: 45-46; referenced in Thomassen, Eivind, op.cit: 197-198. But the board was not informed of that until June 1987.

By early that year, most of the contracts had been signed and it was becoming clear just how expensive the project would actually be.[REMOVE]Fotnote: Johnsen, Arve, op.cit: 288. According to the “section 10 plan” submitted by Statoil to the Storting in 1987, the total cost of the crude oil terminal would be about NOK 1 billion while the price tag for the refinery was almost NOK 6 billion. By June 1987, these figures had risen again to NOK 1.4 billion for the terminal and NOK 7.6 billion for the refinery – in other words, by more than NOK 2 billion.[REMOVE]Fotnote: Nerheim, Gunnar, op.cit: 246-248.

The Statoil board was briefed again about the financial position of the Mongstad development on 17 September 1987, three months after the previous report. The terminal was now priced at NOK 1.4 billion, an increase of NOK 131 million since June, while the new final cost of the actual refinery was put at well over NOK 9 billion – NOK 1.6 billion higher than in June and up by NOK 3.4 billion from the figure presented in the section 10 plan.[REMOVE]Fotnote: Ibid: 248.

In November 1987, the Statoil board resigned and Johnsen had to quit as CEO.

Mongstad was back on the board agenda in April 1988 when Harald Norvik, installed as the CEO relatively recently, briefed the new directors. Investment now exceeded NOK 12 billion, thanks to an increased scope of work, failure to fulfil contracts and an extension to the project period with associated additional management costs. The upgrading and expansion work was now 63 per cent finished. Final completion was set for January/spring 1989. Statoil’s management believed it would make financial sense to complete the project.[REMOVE]Fotnote: Minutes, board meeting, Statoil, 20 April 1988, National Archival Services of Norway.

It is difficult to judge whether the development should have been halted and put on ice once those responsible saw that the costs were steadily rising.

What is certain, on the other hand, is that the overruns came in for harsh media criticism. The term “mong” became an unofficial currency unit – standing originally for NOK 4 billion, the amount of the first published cost increase. That was later adjusted to NOK 6 billion before ending up around NOK 8 billion.

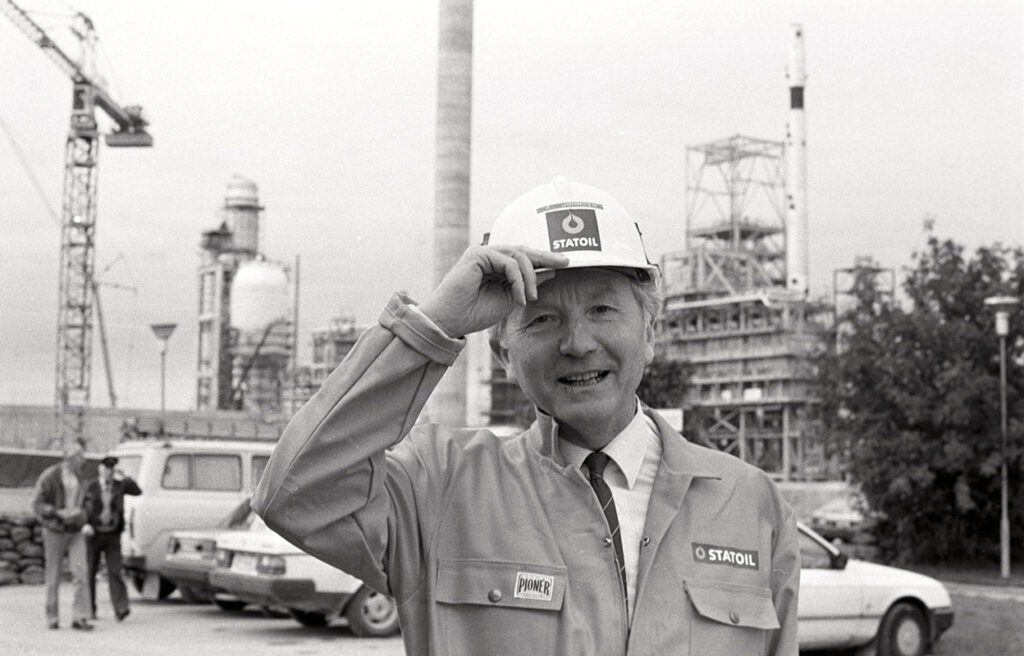

A “mong” is an irreverent unit of measurement for NOK 6 billion. Statoil CEO Arve Johnsen had to resign when the expansion of the Mongstad Plant in the 1980s exceeded this sum. Later, the overruns were even higher, but a mong still seems to have remained at NOK 6 billion.

Iceberg on the horizon

Mongstad would undoubtedly never have been expanded without Statoil’s plans and visions, maintains historian Eivind Thomassen.[REMOVE]Fotnote: Thomassen, Eivind, op.cit: 160. On the other hand, the refinery would very probably have eventually shut down without the expansion and modernisation. Statoil undeservedly acquired a poor reputation as a result of this project. When all was said and done, the company earned big money for the Treasury during the period and much of its other activities went well.[REMOVE]Fotnote: Ibid: 162.

Thomassen makes it clear that financial considerations were not the only reason for the Mongstad modernisation. Regional policy was also in the picture, along with Statoil’s goal of becoming fully integrated.[REMOVE]Fotnote: Ibid: 151.

For his part, Johnsen has written that the management got its first indications that the budget would not hold in early 1987. “We were working on a project which was, for the first time Statoil’s history, not going according to plan.”[REMOVE]Fotnote: Johnsen, Arve, op.cit: 288.

This explanation is a little too simple. Much attention was drawn in 1977-78, for example, to big cost overruns on the Statfjord development. On that occasion, however, the criticism was levelled at operator Mobil.[REMOVE]Fotnote: Nerheim, Gunnar, op.cit: 249. In the Mongstad case, Statoil had nobody to hide behind. It was now the sole shareholder in the refinery – and thereby had sole responsibility.

Johnsen’s Statoil got the credit for the modernised refinery but also had to take the consequences when it became so much more expensive. Most observers agreed that the company could not be blamed for the cost increases, but Johnsen, the rest of the management and the board were criticised for failing to change course when they saw the iceberg on the horizon. On the contrary, they collided with it head-on – and created the mong as a unit of currency.

arrow_backFrom Norol to StatoilWooing the state oil companiesarrow_forward