The Statfjord money machine

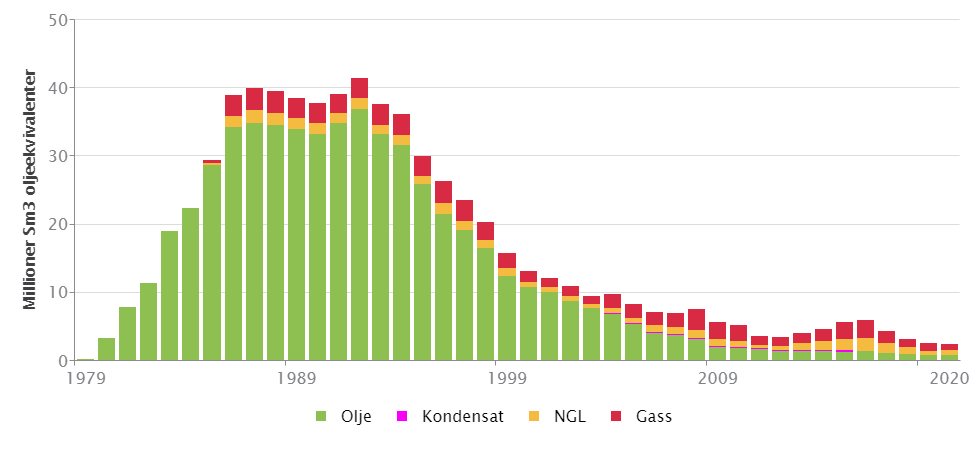

“A pet child has many names”, Norwegians say, and Statfjord bears that out. “A machine for printing money”, “the jewel in the crown” and “a five-star field” are just some of the nicknames it has been awarded.[REMOVE]Fotnote: Borchgrevink, Aage Storm, 2019, Giganten. Det norske oljeeventyret. Statoil – Equinor. Kagge: 91; Lerøen, Bjørn Vidar, 2020, Født til rikdom. En reise i Norges oljealder, Cappelen Damm: 255 and 261. And not without good reason. It came on stream from the Statfjord A platform in 1979 and, with the addition of the B and C installations, reached a plateau output unparalleled on the NCS in 1986-94 (see figure).

Several NCS production records set by the field during this period might prove hard to beat. They include the highest daily flow, at 850 204 barrels of oil on 16 January 1987,[REMOVE]Fotnote: The Statfjord area, https://www.equinor.com/energy/statfjord, accessed 27 April 2022; Lavik, Håkon, 1997, Statfjord. The largest oil field in the North Sea, Statfjord group: 172. while daily production averaged over a week had hit 838 263 barrels the previous autumn. [REMOVE]Fotnote: Highest daily average production (month): 811 587 barrels (November 1986). Highest daily average production (year): 720 449 barrels (1987). (Source: Kyrre Nese).

The field has produced far more than originally estimated.[REMOVE]Fotnote: Gjerde, Kristin Øye, Value creation, https://statfjord.industriminne.no/en/2019/10/28/value-creation/, accessed 27 April 2022. And gross revenues from the field up to January 2020 have been calculated by Equinor to total NOK 1 600 billion.[REMOVE]Fotnote: Increasing value and extending Statfjord. https://www.equinor.com/news/archive/2020-01-09-statfjord, accessed 27 April 2022.

Resources

The Norwegian Petroleum Directorate (NPD) has put original recoverable reserves in Norway’s share of Statfjord at 578.7 million standard cubic metres (scm) of oil, 81.3 million of gas, 43 million of natural gas liquids (NGL) and 0.8 million of condensate.[REMOVE]Fotnote: Statfjord, https://www.norskpetroleum.no/en/facts/field/statfjord/, accessed 27 April 2022; see otherwise https://www.norskpetroleum.no/en/calculator/about-energy-calculator/ for converting the various petroleum components (oil, gas, condensate and NGL). A great deal of this has already been produced, with only 9.5 million scm of the original total remaining in 2020.[REMOVE]Fotnote: Ibid. The figure in 2010 was 23.9 million.[REMOVE]Fotnote: Gjerde, Kristin Øye, op.cit.

Statfjord extends across the median line between Norway and the UK in the North Sea, with the Norwegian share exceeding four-fifths of the total. Over the years, many rounds of negotiation over the field have taken place between the two neighbours, not least on the most appropriate way of exploiting it.[REMOVE]Fotnote: See, for example, annual report, 1979, NPD: 38; Lavik, 1997: 41.

Timing

Statfjord is a good example of the way international conditions can help to determine profitability. It has been pointed out that nobody, including Norway, would have been able to repeat the Norwegian oil success because it was forged through “a quite fantastically lucky combination between national and international conditions”.[REMOVE]Fotnote: Lie, Einar, “Oljehistorien gjentar seg aldri”, Aftenposten, 7 May 2017. Some of the most relevant structural features from Statfjord’s early phase can be highlighted here.

An important aspect of Statfjord is that it came on stream in 1979, at the same time as oil prices rose sharply following the Iranian revolution. Ekofisk received a similar start-up boost from the 1973 oil crisis.

The more general rise in crude prices from that year and over the following decade also made it easier for the Norwegian government to make demands on the foreign oil companies. These included, for example, transferring expertise about the operator role to Norwegian players. A case in point was the agreement with Mobil to train up Statoil in preparation for an agreed transfer of the Statfjord operatorship from the one to the other. This was supposed to happen a decade after the field had been declared commercial in 1974.

High oil prices in the early stages of Statfjord production were a great help to Statoil, which had found itself up to then in a gradually deteriorating financial position. That was because the A platform experienced substantial cost overruns and was also delayed. Not surprisingly, the project was a key topic at Statoil’s board meetings in the years until it came on stream.[REMOVE]Fotnote: See overview of board meetings 1976-1979: SAST, Pa 1339 – Statoil ASA, A/Ab/Aba/L0001: minutes of board meetings, 5 October 1972 to 14 December 1978, 1972-1978: 111-116.

Although Mobil was the operator, the cost overruns and delays were unfortunate for Statoil given that it was so heavily involved through its 50 per cent licensee stake in the Norwegian share of the field. Nor did it help that the company was operating at a loss to start with.

When Statfjord A came on stream two years behind schedule, its start-up coincided with the above-mentioned peak in oil prices. This helped to pay off the cost of the platform in less than 100 days,[REMOVE]Fotnote: Lerøen, Bjørn Vidar, op.cit: 265; concerning the start-up, see board minutes, Statoil, Oslo, 13 December 1979, item 12/79-2 (Source: (SAST, Pa 1339 – Statoil ASA, A/Ab/Aba/L0002: Styremøteprotokoller, 26.01.1979 til 28.06.1985, 1979-1985). which contributed in turn to reducing criticism of the project. Arve Johnsen even revealed a dash of pride when telling the board that “the company would later aim to celebrate oil deliveries from Statfjord, not least in advertisements for Norol”.[REMOVE]Fotnote: Board minutes, Statoil, op.cit.

Gas

While Statfjord is primarily an oilfield, it also contains substantial quantities of associated gas. This is dissolved in the oil, and separates out when the pressure drops. In the early 1980s, a Norwegian milestone in this context was the sales negotiations conducted with foreign buyers over gas resources – where Statfjord was a key field. After initial discussions with the British, who insisted on their 16 per cent of the gas going to the UK, agreement was ultimately reached with a consortium of energy companies on the continent. This deal is renowned for giving the sellers a very good price.[REMOVE]Fotnote: Nerheim, Gunnar, 1996. En gassnasjon blir til, vol 2, Norsk oljehistorie, Norwegian Petroleum Society, Leseselskapet: 61. It forms part of the picture of favourable export terms for the Statfjord resources around 1980.

Wing clipping and price slump

The state took direct control from 1 January 1985 of large parts of the cash flow which earlier passed through Statoil’s books. Despite this “wing clipping”, however, the company retained its full holding in Statfjord. This field thereby assured the company of a large and secure revenue source – even in periods when oil prices were low.

In 1985, Statfjord A alone generated an income corresponding to 12.5 per cent of the Norwegian government budget that year.[REMOVE]Fotnote: Borchgrevink, Aage Storm, op.cit: 92. Following the oil price slump in 1986, these revenues naturally also sank. But the field nevertheless played an important role because of its huge production capacity.

The future

The battles over operatorship and licence interests for Statfjord are long over. However, a key question for many years has been how long this ageing field could justify continued production. Statfjord A has passed through several rounds of cessation plans, only for these to be later revised.[REMOVE]Fotnote: On earlier cessation plans, see for example: Stenberg, Inger Johanne, 2011, “Stenger ned Statfjord A”, Norwegian Broadcasting Corporation, https://www.nrk.no/rogaland/stenger-ned-statfjord-a-1.7560920. In January 2020, Equinor announced yet again that the time frame for shutting down Statfjord A had changed – from 2022 to 2027. The other two platforms – B and C – will stay on stream even longer, to 2035.[REMOVE]Fotnote: Increasing value and extending Statfjord, https://www.equinor.com/news/archive/2020-01-09-statfjord, accessed 27 April 2022. They were originally scheduled to cease production in 2025.[REMOVE]Fotnote: Skarsaune, Erlend and Myrset, Ola, “Equinor bekrefter: Forlenger levetiden på Statfjord A”, Stavanger Aftenblad, online edn, 9 January 2020.

Statfjord thereby represents not only a big money machine, but also an unusually durable one.

arrow_backGullfaks – the big qualifying testTommeliten problemsarrow_forward