Acquiring a slice of Saga

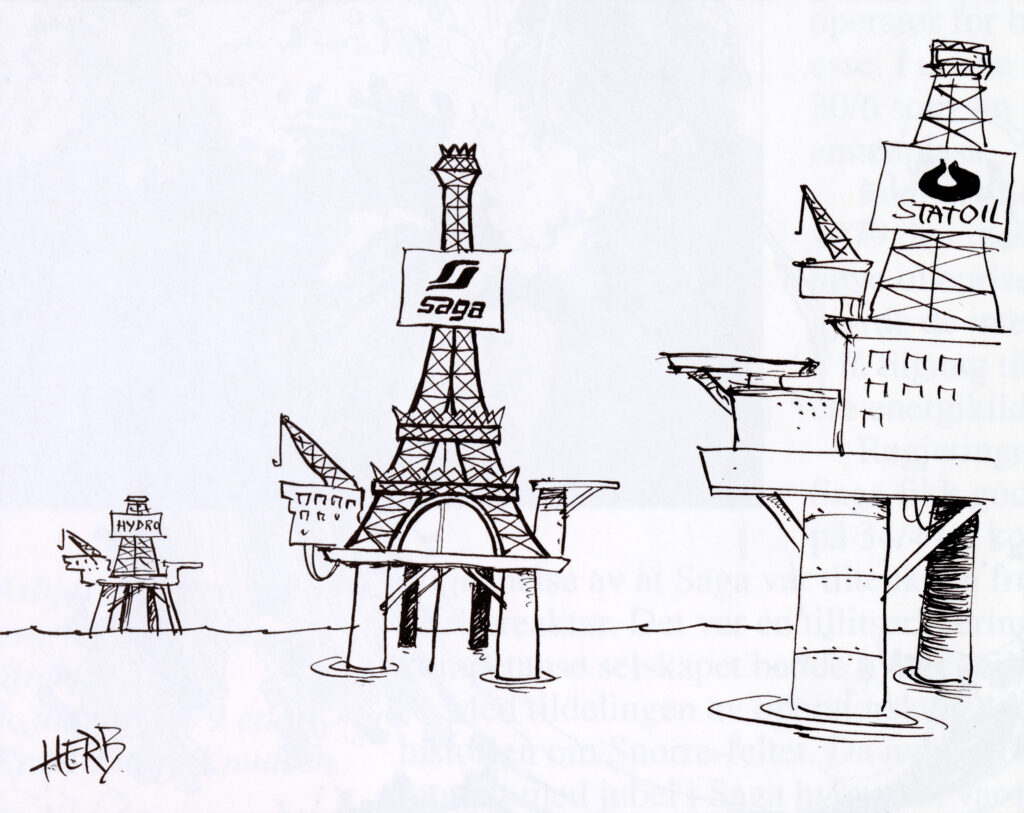

Norwegian petroleum policy was long based on a principle that three domestic oil companies would ensure a balance between state control and private initiative. In addition to Statoil and Saga, the trio included Hydro in a kind of intermediate position as partly state-owned.

Saga was always the smallest of the three, and Hydro in particular perceived from an early stage real opportunities to secure a stake there. It did just that in 1989 by acquiring 13 per cent of the Saga shares. That created a good deal of political noise for contravening the prevailing oil policy model.

Statoil stayed more in the background for the time being.[REMOVE]Fotnote: Lie, Einar, Myklebust, Egil and Norvik, Harald, 2014, Staten som kapitalist. Rikdom og eierskap for det 21. århundre, Pax: 76. That was an example of the way the state as sole owner limited its freedom of action compared with other oil companies. Nevertheless, it was not long before Statoil also took action and acquired a substantial shareholding in Saga from Volvo in the early 1990s.[REMOVE]Fotnote: Lerøen, Bjørn Vidar, 2002. Drops of black gold. Statoil 1972-2002, Statoil: 93.

Saga’s problems

Big financial difficulties built up for Saga in the second half of the 1990s. An important reason was the acquisition of oil company Santa Fe from the Kuwait Petroleum Corporation in 1996. After a bidding round, Saga paid USD 1.23 billion for this asset – which has afterwards been assessed as too much. The purchase admittedly made the Norwegian buyer a much bigger oil producer, but the problems piled up when the cost of crude prices fell in 1998. Another challenge was that Saga entered into long-term contracts while oil prices were low, and thereby lost out substantially when they recovered.

A structural feature in the late 1990s, which can also illustrate the problems facing several Norwegian oil companies, was the global merger wave which washed over the petroleum sector. BP joined with Amoco, for example, and Mobil with Exxon, while Total, Fina and Elf linked up. The corporate structure of the industry thereby became dominated by a few giants. In that context, the Norwegian companies became smaller than ever.

The contrast was particularly great for Statoil, which terminated the alliance it had maintained with BP throughout the 1990s. For its part, Saga was in a precarious position as a small company with a very difficult financial condition.

In these circumstances, both Statoil and Hydro were keen on a takeover. As noted, Hydro as a listed company was freer to manoeuvre in this landscape than Statoil.

Statoil’s acquisition

Statoil increased its holding in Saga to 19.4 per cent in 1998. It described this move as “a result of [a] desire to protect the assets already invested in Saga in order to strengthen further the operational collaboration between the two companies.”[REMOVE]Fotnote: Annual report, 1998, Statoil: 13. (The reference to the annual report in this text refer to the Norwegian edition of the report); Nore, Petter, 2003. Norsk Hydro’s Takeover of Saga Petroleum in 1999. A Case Study, report 73, Power and democracy project report series, University of Oslo: chapter 3.3.

Of particular interest is a memorandum to the board from CEO Harald Norvik, where he notes that “Statoil’s freedom of action as a company will be put to the test over the question of acquiring shares in Saga Petroleum. The thesis of the three Norwegian oil milieus still has a very strong place in the Norwegian political community, and many politicians do not wish Statoil to have an independent commercial role in the development of Saga”.[REMOVE]Fotnote: Kommunikasjonsstrategi i Statoil (marked “To the board”) by Harald Norvik, dated 9 December 1998: 9. Regional State Archives in Stavanger, Pa 1339 – Statoil ASA, A/Ab/Abb/L0046, labelled “styremøte nr. 11/98”. So it is not surprising that relations with Saga became a recurring topic at Statoil’s board meetings during the autumn and winter of 1998-99.[REMOVE]Fotnote: Minutes, board meetings, Statoil, 28 October, 24 November and 16 December 1998 as well as 26 January 1999. Regional State Archives in Stavanger, Pa 1339 – Statoil ASA, A/Ab/Abb/L0046.

Norvik, in other words, related the Saga issue to the state’s role as sole owner of Statoil.[REMOVE]Fotnote: Kommunikasjonsstrategi, op.cit: 9. Insufficient freedom of action with regard to the other company demonstrated – at least to the CEO – the need for greater distance from the owner.

The final act of Saga’s independent history played out in the middle of the partial privatisation process for Statoil.

Eventful months

The winter, spring and summer of 1999 were to prove unusually eventful for Statoil. In January, Norvik had brought the privatisation discussion seriously into the public arena through a speech in Sandefjord. Later that spring, he resigned in the wake of cost overruns on the Åsgard development.

As if that were not enough, Hydro made a bid for Saga on 10 May.[REMOVE]Fotnote: Aanestad, Ola M, “Full kamp om olje-hegemoniet”, Stavanger Aftenblad, 11 May 1999: 2. This prompted a hastily called meeting of the Statoil board, with the shareholding in Saga as the only item on the agenda. Issues discussed included whether the company should enter into an agreement with Hydro on its takeover.[REMOVE]Fotnote: Minutes, board meeting, Statoil, 18 May 1999, Regional State Archives in Stavanger, Pa 1339 – Statoil ASA, A/Ab/Abb/L0047, labelled “Styremøte nr. 9/99”. France’s Elf also showed interest, and Saga CEO Diderik Schnitler aired the possibility of an alliance with foreign interests. However, petroleum and energy minister Anne Enger Lahnstein from the Centre Party signalled that it was “important to work for a Norwegian solution”.[REMOVE]Fotnote: Aanestad, Ola M, op.cit.

On 27 May 1999, Statoil and Hydro reached agreement on a joint takeover of Saga.[REMOVE]Fotnote: Lerøen, Bjørn Vidar, op.cit: 94. Key components in this deal were that Statoil would acquire important licence interests and operatorships from Saga. These would ensure more efficient production from the Halten Bank in the Norwegian Sea and the Tampen area of the North Sea. Norvik noted that this was important in order for the company to remain the leading player on the Norwegian continental shelf.[REMOVE]Fotnote: Aanestad, Ola M, “Statoil og Hydro deler Saga”, Stavanger Aftenblad, 27 May 1999: 8. Overall, it acquired about 25 per cent of Saga’s assets.[REMOVE]Fotnote: Lerøen, Bjørn Vidar, op.cit: 94.

When this process was completed, three companies had been reduced to two and Norway had experienced its own mini-version of the international trend towards fewer and larger entities in the oil industry.

arrow_backGas to food – bioprotein at TjeldbergoddenOlav Fjell – with a banking backgroundarrow_forward