Lufeng – first foreign operatorship

The pragmatic communism which followed the Mao era staked out a new course for China, with a number of reforms introduced in the 1980s. Management of the petroleum sector was transferred to three national oil companies: the China National Petroleum Corporation (CNCP) for activities on land, the China Petroleum and Chemical Corporation (Sinopec) to process and sell petroleum products, and the China National Offshore Oil Corporation (CNOOC), established in 1982 to direct offshore operations.[REMOVE]Fotnote: Inkpen, Andrew, Moffett, Michael H and Ramaswamy, Kannan, The Global Oil and Gas Industry: Stories from the Field, 2017: 151-155.

Several routes in

Statoil negotiated with the last member of this trio in seeking entry to the Chinese continental shelf (CCS). The company farmed into two licences in these waters in 1985, including 9.8 per cent of a trial production project operated by Total in the Beibuwan area of the Gulf of Tonkin. Statoil also joined a licence operated by Cluff Oil in the Yellow Sea.[REMOVE]Fotnote: Annual report, 1985, Statoil. This China involvement was run from head office, and the company also had a representation office at the Norwegian embassy in Beijing.[REMOVE]Fotnote: Annual report, 1989, Statoil.

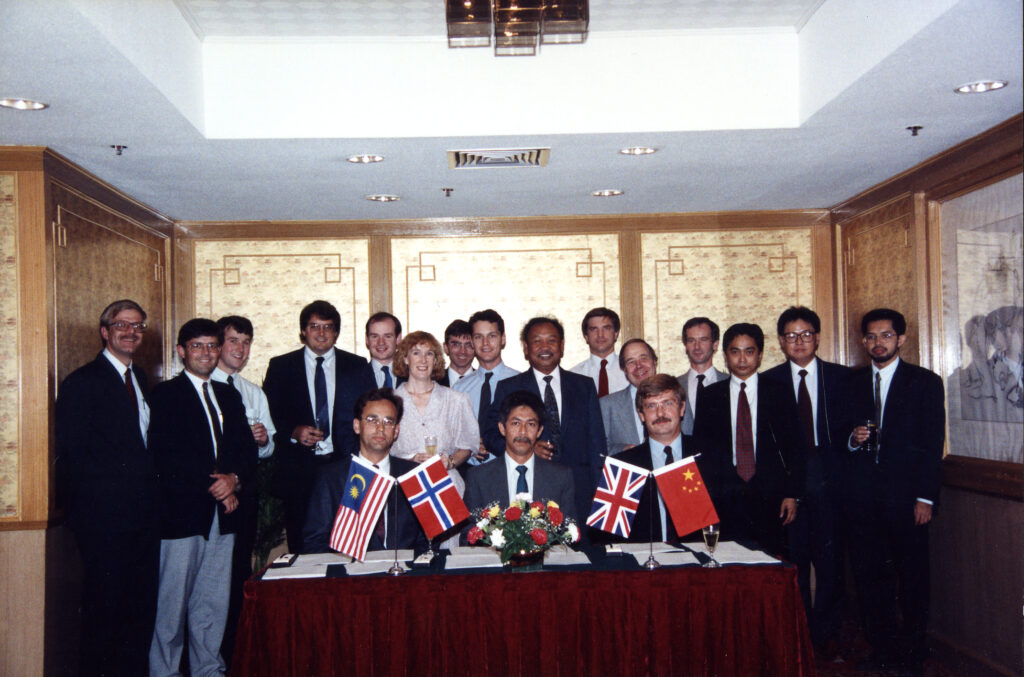

The strategic alliance with BP brought Statoil a little deeper into exploration activity off China. Known as the protocol, this deal was signed on 28 August 1990 and covered three areas. One was international exploration and production offshore Angola, Nigeria, China and Vietnam and on land in the Soviet Union. The second involved gas production and sales, while the third related to research and development (R&D). The BP alliance was important for Statoil, whose strategic plan aimed at obtaining roughly a third of its oil production from areas outside the Norwegian continental shelf (NCS) by around 2010.[REMOVE]Fotnote: Annual report, 1994, Statoil.

Even before the alliance was forged, BP had secured a Chinese offshore licence for an area south-west of Hong Kong and south of the tropical island of Hainan, close to the border with Vietnam. BP was operator for exploration and led this work from London. Statoil had personnel involved in all parts of the activity. However, drilling results were disappointing and the alliance partners resolved in 1994 to withdraw from all joint projects in China.[REMOVE]Fotnote: Ibid.

Important operatorship on Lufeng

Nevertheless, Statoil continued its involvement in the country on its own account. With more than a billion inhabitants, China had a growing economy. “The whole world’s factory” had a constantly increasing need for oil as an energy bearer, in addition to the coal which it was a major consumer of. China was moreover interested in learning more about technology related to offshore petroleum production.

In 1996, Statoil farmed into the Lufeng 22-1 oil field in the South China Sea, about 250 kilometres south-east of Hong Kong. Located in 330 metres of water, this discovery had been made by Occidental in 1983 and the seller was Ampolex.[REMOVE]Fotnote: https://www.equinor.com/news/archive/2009/04/17/Lufeng170409

The transaction gave Statoil a 75 per cent interest in the field, with the CNOOC holding the rest. A development decision was taken in 1996. Although not that large, Lufeng was highly significant because it gave Statoil the opportunity to serve as an operator in foreign waters for the first time.

An operations organisation was established at Shekou in China.[REMOVE]Fotnote: Annual report, 1996, Statoil. For much of the time, only a few Norwegians from Statoil were seconded there. The workforce otherwise comprised local employees. Since the Chinese staff had limited international experience, personnel from Norway were dependent in interpreters.[REMOVE]Fotnote: Hatlestad, Helge, 2021, Femti år med oljeproduksjon: min historie. They also had something to learn about cultural differences. The Chinese were very obedient to authority and always answered in the affirmative if their superior asked about anything. Such things could lead to misunderstandings. The Norwegians therefore had to learn the unwritten rules of Chinese behaviour to collaborate with the locals.[REMOVE]Fotnote: Roald Riise, by e-mail, 14 June 2021. Development and production were pursued in collaboration with the China Offshore Oil Nan Hai East Corporation, a CNOOC subsidiary.

A dozen larger and smaller oil discoveries were made in a radius of 200 kilometres from Lufeng. These encouraged hopes that more opportunities would open up for Statoil. Estimated recoverable oil from Lufeng was about 130 million barrels, to be produced over three-four years.

The chosen development solution, with a floating production, storage and offloading (FPSO) unit tied back to subsea wells in a template, was similar to approaches often used on the NCS in the 1990s.[REMOVE]Fotnote: Gjerde, Kristin Øye and Nergaard, Arnfinn, Getting down to it. 50 years of subsea success in Norway: 169. Statoil thereby brought Norwegian technology and suppliers to China.

Built as a multipurpose shuttle tanker (MST), the Munin FPSO was tied to five seabed wells in a single template. Its monohull design was suited to the water depth of 330 metres.[REMOVE]Fotnote: Statoil Magazine (print edition), no 3, vol 17, 1995.

A production ship could move in response to wind and weather while moored. Norwegian experience with such vessels in the tough weather conditions of the North and Norwegian Sea proved valuable. The subtropical climate of the South China Sea, was characterised by periodic typhoons and monsoon rains. The former usually lasted a little over a day and generated waves with average heights of eight metres. Another local weather phenomenon was cold currents flowing from Siberia, which also brought strong winds.[REMOVE]Fotnote: https://www.offshore-technology.com/projects/lufeng/.

Drilling in the South China Sea

The Statoil personnel who participated in drilling on Lufeng from the Nanhai 5 rig in 1997 found it a very interesting time. Bjørn Risvik reports that they faced “challenges with logistics, hurricanes, weird currents and an unfamiliar language”. The positive side was the opportunity to put Statoil’s subsea expertise into practice in another country. The company was responsible for training up the Chinese. Risvik also found it enjoyable to form new friendships across national frontiers.

Drilling the five wells progressed quickly. They were equipped with a new type of horizontal Xmas tree (valve assembly). When Lufeng came on stream on 27 December 1997, oil prices were on the way down to a low point of USD 10 per barrel. Even though this was a small development and its profitability was not that good, however, the field had great symbolic importance as the first production abroad with Statoil as the operator.[REMOVE]Fotnote: Bjørn Risvik on Equinor’s 50th anniversary Facebook page, 26 November 2019.

Production regularity was almost 99 per cent.[REMOVE]Fotnote: Lufeng was to be developed as a low-cost fast-track project with new technology – multiphase flow pumps from an MST A 15-page Lufeng Functional Requirements report was written and checked for deviations at high speed by Johan Bruun Olsen to avoid delays. Source: Hans Jørgen Lindland by e-mail, 14 June 2021. This successful result meant that the field’s producing life was extended to 2002 and again to 2004.[REMOVE]Fotnote: Annual report, 1999, Statoil. In the autumn of 2003, however, water intrusion in the wells was found to have reached such a level that it accounted for more than 90 per cent of the liquid reaching the surface. The field either had to shut down for the old wells to be refreshed, or new wells were needed.

In 2004, the second option was chosen. Production ceased and the MST was moved away for leasing to another operator during the shutdown.[REMOVE]Fotnote: Hatlestad, Helge, op.cit. That initiated phase two in the field’s history.

New life for Lufeng

The initiator and driving force behind a second phase for Lufeng was Roald Riise, a Statoil veteran with long experience of drilling and wells. He believed opportunities existed for a profitable upgrading of the relevant block. New sidetracks were drilled out from three of the existing wells, and the MST was back in place by June 2005 to resume production.

This entire operation was conducted without accidents or lost-time injuries (LTIs). Lufeng received the chief executive’s prize for health, safety and the environment (HSE) in 2005, when the field had gone more than three years without an LTI.[REMOVE]Fotnote: https://www.equinor.com/news/archive/2005/12/14/LufengWinsTopHSEAward

The field ultimately produced twice the amount of oil expected when the development decision was taken. In other words, its recovery factor increased from about 20 per cent of the oil in place to more than 40 per cent. Oil prices rose to almost USD 100 per barrel during Lufeng’s final years on stream, yielding good profitability for its licensees. The field was shut down on 16 June 2009 – the first Chinese offshore field to cease production officially.[REMOVE]Fotnote: Hatlestad, Helge, op.cit.

No more projects

Statoil’s Beijing office had worked on possible new projects and technology collaboration with the Chinese. Petroleum and energy minister Thorhild Widvey visited in 2005, and was naturally interested in future prospects for Norwegian companies in China. Her Chinese opposite number, Sun Wensheng, responded that the country welcomed participation by foreign oil companies – particularly for deepwater projects.

Up to 2005, the CNOOC had collaborated with 20 foreign oil companies and investment on the CCS had reached USD 100 billion.[REMOVE]Fotnote: TU, 11 February 2005, https://www.tu.no/artikler/kina-vil-laere-om-olje-og-vann/263312. However, Chinese companies had a monopoly of all petroleum-related activities on land.

Like Statoil, the Chinese themselves were internationalising their oil activities in the 2000s. CNOOC Ltd, for example, which acquired listings on the New York and Hong Kong Stock Exchanges in 2001, sought to buy itself into the USA in 2005 but was blocked by the US authorities. It had better success in African and South American countries where China provided loans in exchange for access to resources. The Chinese made a particularly big commitment to Africa in order to secure oil, gas and minerals.[REMOVE]Fotnote: Inkpen, Andrew, et.al, op.cit: 156-161. China was a great power making big economic progress. A pertinent question is then: how interested were the Chinese in Statoil?

An equally pertinent question is how interested Statoil was in China. Helge Hatlestad, who was involved in technology collaboration, believed that at least two projects were matured where it would have been possible for Statoil to be an operator/participant in China. After the merger with Norsk Hydro’s oil and energy division in 2007, however, the company’s management was more concerned to become established in Russia and the Middle East. Activity in Beijing received no priority.

When Chinese regime critic Liu Xiaobo was awarded the Nobel Peace Prize in 2010, Statoil’s involvement in China was at a low ebb. This award nevertheless put a stop to most Chinese collaboration with Norwegian companies for a long period.

arrow_back24 years with Venezuelan oil sandsTechnology development in Statoilarrow_forward